Average Cost Definition

Content

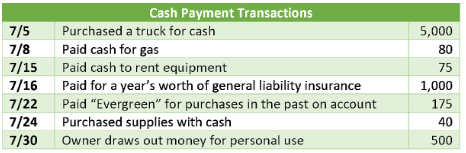

As the volume of goods or services increases, so will variable costs. Likewise, if the volume of goods or services decreases, the variable how to calculate cost per unit costs will decrease. To calculate cost per equivalent unit by taking the total costs and divide by the total equivalent units.

Although rounding differences still may occur, this will minimize the size of rounding errors when attempting to reconcile costs to be accounted for with costs accounted for . Use the cost per equivalent unit to assign costs to completed units transferred out and units in ending WIP inventory. To calculate the per unit overhead costs under ABC, the costs assigned to each product are divided by the number of units produced. In this case, the unit cost for a hollow center ball is $0.52 and the unit cost for a solid center ball is $0.44. In this article, we will explore fixed costs and the formulas used to calculate them. We’ll also examine variable costs, as they can play a role in determining fixed costs.

The Beginner’s Guide To Product Photography

Sam’s Sodas is a soft drink manufacturer in the Seattle area. He is considering introducing a new soft drink, called Sam’s Silly Soda. He wants to know what kind of impact this new drink will have on the company’s finances.

Philips: Recall Uncertainties Create Value Opportunity – Seeking Alpha

Philips: Recall Uncertainties Create Value Opportunity.

Posted: Wed, 08 Dec 2021 05:59:00 GMT [source]

For example, if your total fixed costs are $50,000, and you sold 5,000 units, your fixed cost per unit would be $10. Due to this, average fixed cost is beneficial for pricing goods and services. When you know the fixed cost to produce your product or service before you factor in the variable costs, you are able to work with a consistent expense. This consistency helps determine the starting price point of your good or service. First, we need to know our total costs for the period by adding beginning work in process costs to the costs incurred or added this period. Then, we compare the total to the cost assignment in step 4 for units completed and transferred and ending work in process to get total units accounted for. In the previous page, we discussed the physical flow of units and how to calculate equivalent units of production under the weighted average method.

What Is The Variable Cost Ratio?

1,000 units were completed and transferred out to the Finishing department ; thus 1,000 units were started and completed during May. A business’s break-even point is the stage at which revenues equal costs. Once you determine that number, you should take a hard look at all your costs — from rent to labor to materials — as well as your pricing structure.

- To calculate the unit price, first convert the total quantity to the desired unit.

- Literally speaking, the unit cost for the first shoe off that production line might be measured in the millions of dollars.

- Since fixed costs need to be paid regardless of output production, it is important for a business to accurately calculate its fixed costs.

- If this is not possible or too time-consuming, consider the following option to calculate the fixed cost.

- The final number you need for the cost per unit calculation is the number of units you’re producing.

Insurance rates, such as property insurance and healthcare costs, will be determined in a contract and calculated as fixed costs. The larger the number of units you produce and sell, the smaller the sale price needed to breakeven, and vice versa. If selling price is set, profits may accrue at high volumes of production but losses occur at low volumes. For the company to make a profit, the selling price must be higher than the cost per unit. Setting a price that is below the cost per unit will result in losses. It is, therefore, critically important that the company be able to accurately assess all of its costs.

Why Is Cost Per Unit So Important?

In this article, we discuss what a cost per unit is, why it’s important, how to calculate it and provide an example of a cost per unit calculation. Four steps are used to assign product costs to completed units transferred out and units in work-in-process inventory at the end of the period. CThis must match total costs to be accounted for shown in Figure 4.5 “Summary of Costs to Be Accounted for in Desk Products’ Assembly Department”. Although not an issue in this example, rounding the cost per equivalent unit may cause minor differences between the two amounts. Company ABC received an order to deliver 3,000 packaging items to another firm for a total sales price of $125,000. The management wants to calculate the gross profit for this order by determining first the total variable cost. ABC provides a way to allocate costs more accurately when overhead costs are not incurred at the same rate as direct labor dollars.

- The number of orders, setups, or tests the product actually uses does not impact the allocation of overhead costs when direct labor dollars are used to allocate overhead.

- They play a role in several bookkeeping tasks, and both your total variable cost and average variable cost are calculated separately.

- As production or sales fluctuate, fixed costs remain stable.

- In accounting and business, the breakeven point is the production level at which total revenues equal total expenses.

Furthermore, production economies of scale can lower the threat of new entrants into the industry. Variable costs vary depending on the level of output produced. These expenses have a further division into specific categories such as direct labor costs and direct material costs. Direct labor costs are the salaries paid to those who are directly involved in production while direct material costs are the cost of materials purchased and used in production.

Cost Of Production:

The more activities identified, the more complex the costing system becomes. Some companies limit the number of activities used in the costing system to keep the system manageable.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

How To Calculate Real Time Cost Per Unit

Fixed costs will stay relatively the same, whether your company is doing extremely well or enduring hard times. As production or sales fluctuate, fixed costs remain stable. Think of them as what you’re required to pay, even if you sell zero products or services. The total cost per unit is a figure that’s integral to running a good business. If you don’t know how much each service or product costs to produce, how can you actually know what to sell it for and still turn a profit?

On a basic level this can simply be the sum of the total cost of each operator on the line per hour x the number of hours per shift. Depending on the makeup of your production crews this cost can vary. In an ideal world, you could reduce variability by structuring crews with identical skills. Some people average those costs if they have multiple crews.

Fixed And Variable Costs:

Now let’s consider what this information would mean for your business. You already know that your variable cost per unit is $0.60 per cookie. Combine that with your average fixed cost of $0.65 per cookie, and you have a total cost of $1.25 per cookie. So if you want to make a profit, you know that your retail sale price will have to be greater than $1.25 per cookie. Now that you know the difference between fixed costs and variable costs, let’s look at how you can calculate your total fixed costs. In simplest terms, fixed costs are the expenses that do not change over a set time.

- Direct labor costs are limited to the wages paid to workers directly involved with making the product.

- You would also know your output’s total, so your total variable cost becomes a matter of simple multiplication.

- We also reference original research from other reputable publishers where appropriate.

- We will calculate a cost per equivalent unit for each cost element (direct materials and conversion costs .

- A fixed cost is not permanent, but any changes to it will not be directly related to output.

- It becomes hard for companies to set appropriate prices for the goods manufactured when they are unaware of per piece cost.

This means a fixed cost should be calculated over a certain amount of time, usually a short period of a month, four months, six months, or one year. Fixed Costs – Fixed costs are ones that typically do not change, or change only slightly. Examples of fixed costs for a business are monthly utility expenses and rent. We will calculate a cost per equivalent unit for each cost element (direct materials and conversion costs . For example, if it costs $60 to make one unit of your product and you’ve made 20 units, your total variable cost is $60 x 20, or $1,200. Variable costs earn the name because they can increase and decrease as you make more or less of your product.

Total Fixed Costs+ Total Variable Costs

To calculate fixed cost per unit, start by finding your total fixed costs using one of the methods outlined in this article. Notice in this formula it is your responsibility to calculate the total variable costs of your business before you determine your fixed cost. It would be reasonable to know your variable cost per unit since this is a cost affected by output.

What to consider before implementing a B2B marketplace strategy – CFO Dive

What to consider before implementing a B2B marketplace strategy.

Posted: Wed, 08 Dec 2021 22:08:01 GMT [source]

He has produced multimedia content that has garnered billions of views worldwide. The easiest way to lower the total manufacturing cost is to outsource production to a more efficient manufacturer or find a cheaper supplier. For example, company A ltd incurred the following expenses during the one month. In this case, the total weight is 500 ounces, and the total unit is 10. Conor McMahon is a writer for Zippia, with previous experience in the nonprofit, customer service and technical support industries. He has a degree in Music Industry from Northeastern University and in his free time he plays guitar with his friends. Conor enjoys creative writing between his work doing professional content creation and technical documentation.

In implementing Lean.

One action is must know total cost per piece produce or delivered.

Calculate Cost per Unit baseline.

Reduce the 7 was…— Bambang Eko Cahyono (@bembi_cahyo) July 27, 2016

The first section of a company’s income statement focuses on direct costs. In this section, analysts may view revenue, unit costs, and gross profit. Gross profit shows the amount of money a company has made after subtracting unit costs from its revenue. Gross profit and a company’s gross profit margin are the leading metrics used in analyzing a company’s unit cost efficiency. A higher gross profit margin indicates a company is earning more per dollar of revenue on each product sold. A company’s financial statements will report the unit cost. Companies that manufacture goods will have a more clearly defined calculation of unit costs while unit costs for service companies can be somewhat vague.

5th Grade Navesink SELLS Club (Sinkers Earning Lifetime Leadership Skills). School store teaching mental math to calculate cost & change, picking new products based on best cost per unit & pricing for profit. @NavesinkSchool @MTPSpride @Moyer7111 @newcomb_joy @Mr_KCullen pic.twitter.com/fJlfYbDZSO

— Melissa Rachinsky Eckelman (@Mortimer13) February 16, 2019

Comments

No comment yet.